Hyderabad’s #1 Choice for Workday Training in Hyderabad {2025}

Workday Benefits Course in Hyderabad

Topic Overview

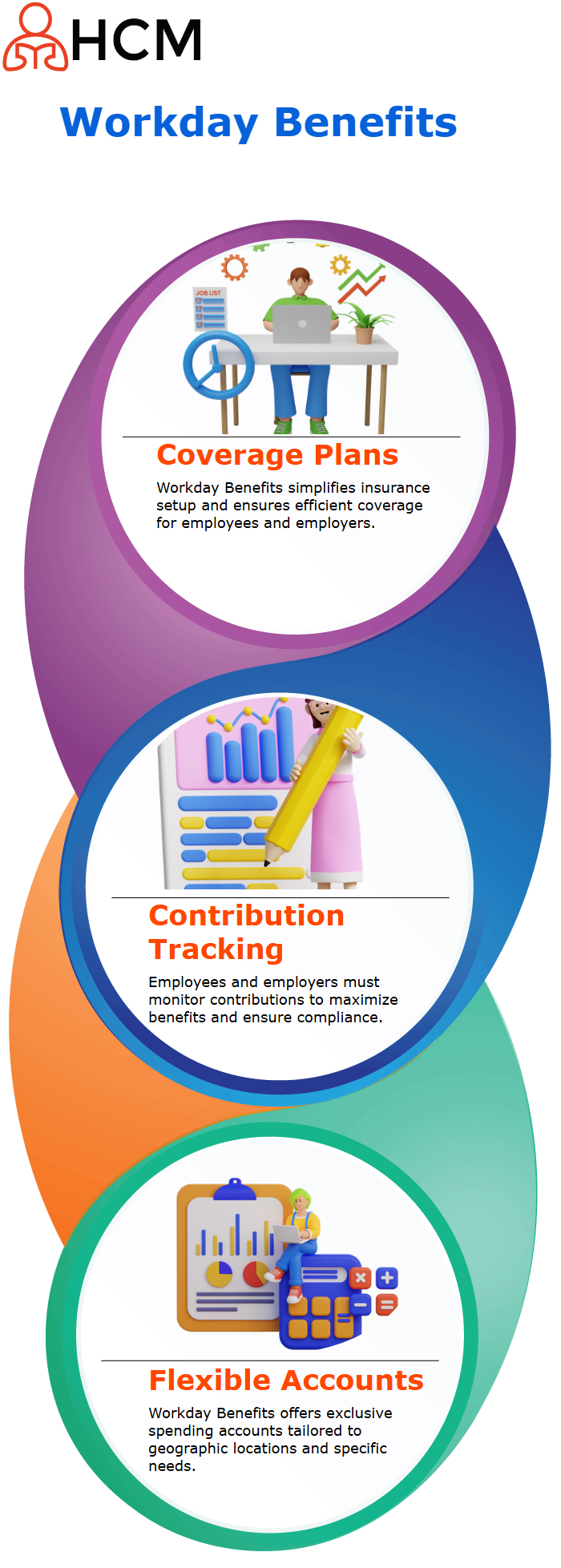

Understanding Coverage and Contributions in Workday Benefits

Workday Benefits core features, coverage, and contributions.

We encounter difficulties setting up plans, but we manage to work them out and move ahead successfully.

When we noticed that pre-filled water had not been updated, Workday Benefits became essential in rectifying this situation.

Workday Benefits plays a vital role for both employees and employers, and the Workday Benefits course in Hyderabad offers practical knowledge to manage contributions accurately.

They do not rely on old methods but have plans set in motion instead.

At times, outdated systems do not reflect the most up-to-date versions, leading to errors.

Furthermore, employers sometimes pay themselves without informing employees.

Perhaps this occurrence has created problems at various stages of our plan, since implementing additional retirement incentives and two new plans under Workday Benefits.

We believe we now have everything under control.

These plans are designed to facilitate effective spending account management and maximise employees’ benefits, with Workday Benefits handling any insurance-related concerns as needed.

Streamlining Coverage Through Workday Benefits

Setting up insurance can often be a complex and involved process, requiring multiple rates and coverage specifications to be fulfilled.

Employees often find healthcare and dependent coverage options confusing, but the Workday Benefits course in Hyderabad offers the guidance needed to navigate these choices effectively.

Workday Benefits’ flexible spending account structure is exclusive to certain geographic zones within the US and may only be applicable in specific instances.

Employees and employers should closely track contributions made towards Workday Benefits’ perk accounts to verify conformance and maximise benefits.

Why don’t we set up one administered through Workday Benefits to provide coverage efficiently and effectively?

Workday Benefits offers flexible contribution plans, providing minimum and cumulative selections that allow for tailored planning.

Health Savings Accounts Now Available via Workday Benefits

Employees and their family members can now access health savings accounts through Workday Benefits, and both employees and family members are eligible to enrol up to their contribution limits.

Annual employee contributions cannot exceed $2,500, while employers will provide their share to ensure financial stability within Workday Benefits.

Employees enrolled in Workday Benefits should understand all available plan options, including healthcare and dependent coverage options.

Maximising enrollment success requires thorough research, and the Workday Benefits course in Hyderabad is an excellent starting point for employees.

The timing of contributions has a significant influence on budgeting plans, particularly when working every month, which allows employees to maximise Workday Benefits over an entire year.

Adapting Workday Benefits to Evolving Workplace Needs

Workday Benefits must adapt to changing workplace needs.

Without a doubt, workers will take full advantage of opportunities offered to them when selecting plans during enrollment and at events such as hiring new employees, marriage, or the addition of dependents.

Offering financial support and regulatory compliance, Workday Benefits also provides training through the Workday Benefits course in Hyderabad to help employees fully understand their options.

Through structured contributions, employees can meet their financial obligations while effectively utilising the Workday Benefits available to them.

Employee Contributions in Workday Benefits

Understanding worker contributions is an integral part of Workday Benefits systems; therefore, understanding their workings is crucial.

For instance, say you come in to contribute $1,000 but then realise there might be better uses for that sum elsewhere.

Perhaps looking ahead and planning how and when you plan to spend it would yield greater results than simply offering one sum upfront.

The customisation of Workday Benefits according to your contributions is covered in detail in the Workday Benefits course in Hyderabad.

A key advantage is their ability to accommodate customers with varied health requirements.

Standard options often prove adequate, yet the potential to make modifications remains.

Companies using Workday Benefits ensure their contributions correspond with their specific conditions.

How Workday Benefits Optimise Coverage Adjustments

Workday Benefits streamlines coverage adjustments, making it quick and straightforward to add or delete unnecessary coverage types.

Both employees and employers find precisely the coverage that meets their needs through customisable alternatives.

Companies can maintain valuable, up-to-date contributions through Workday Benefits, as explained in the Workday Benefits course in Hyderabad.

It can provide its workforce with more comprehensive health insurance.

Still, as customer health conditions change over time and updates must be implemented, Workday Benefits offers essential flexibility to make necessary modifications.

Refining Contributions with Workday Benefits

Workday Benefits enhances contributions that have the desired effect on employees.

Employers can make necessary modifications without impacting financial agreements.

Workday Benefits not only offers employees the freedom of choosing what best meets their financial obligations, but it also enables companies to tailor their benefits packages as needed.

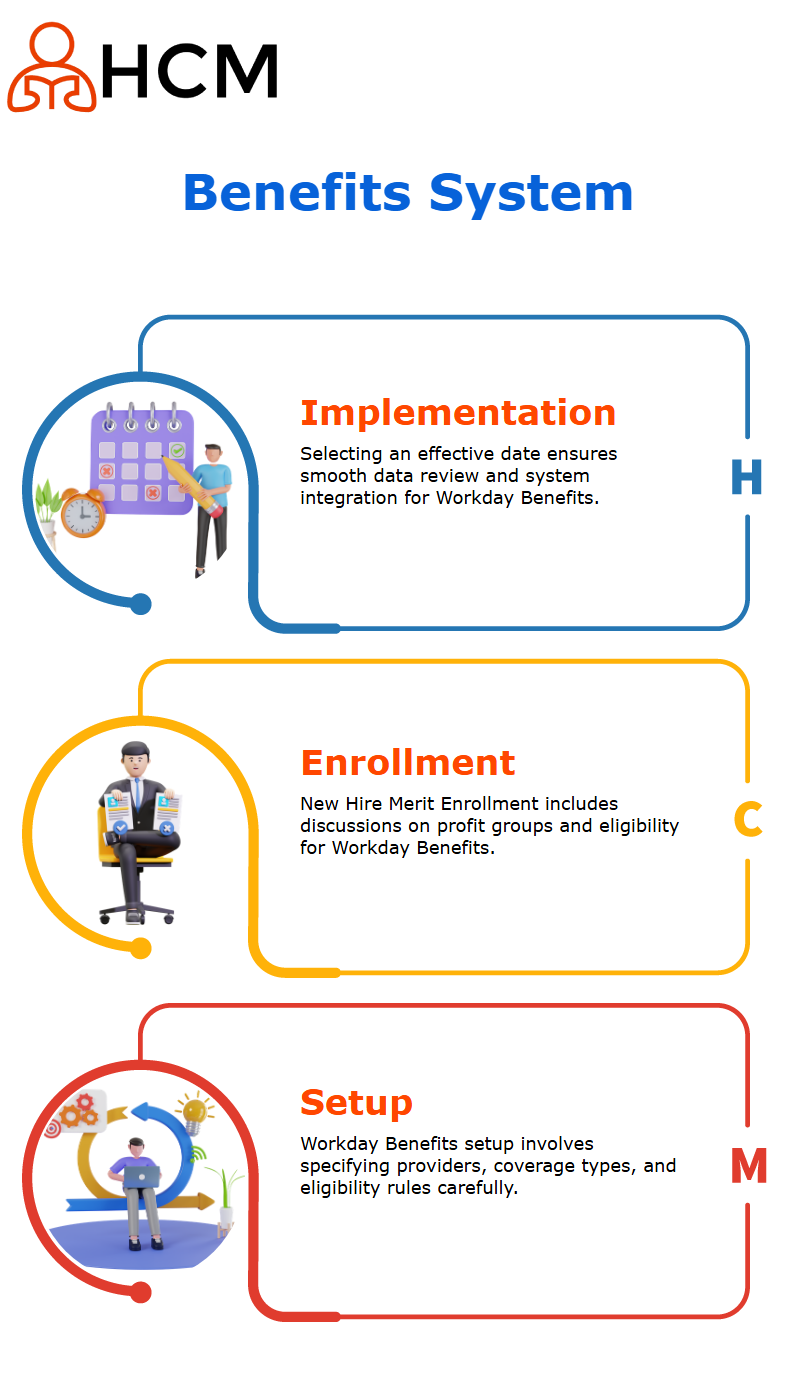

Functional Essence Behind Application of Workday Benefits

Workday Benefits has several implications for companies, and an assignment must be submitted.

All components should be organised accordingly so as not to disrupt business.

New Hire Merit Enrollment will feature discussions on profit groups, essential to developing the Workday Benefits system, with further insights available through the Workday Benefits course in Hyderabad.

Selecting an effective date for Workday Benefits implementation is equally significant.

We typically set this to 1/1/1900 so that we can begin reviewing data that dates back before then.

As it remains an open question, setting lively influence will depend on each company.

When processing historical data from previous dates, Workday Benefits guarantees that no data inconsistencies occur.

Setting Up Workday Benefits Plans

Workday Benefits plan creation involves several steps.

When adding providers, all related plan types, coverage types, and eligibility rules must be specified, including coverage details such as Metro train passes.

When we name providers, we then identify all their related plan types and coverage types, such as Metro train pass coverage on Workday Benefits plans.

Implementing a Workday Benefits plan is a comprehensive process that extends beyond setup, a topic thoroughly explored in the Workday Benefits course in Hyderabad.

Instead, its creation must also take careful account of who qualifies for it.

Companies typically establish eligibility conditions for their employees to ensure that only full-time workers receiving Workday Benefits meet these specific conditions, which involve retaining their jobs.

With Workday Benefits, this process is made easier than ever before.

Conserving Workday Benefits Data

One of the many impressive aspects of Workday Benefits is its ability to manage provider data effectively.

Companies using Workday Benefits can store items such as maximum contribution details, coverage plans, and provider evidence in a single entry within their system, saving both time and resources in the process.

Configuring data flow to integrate external systems with Workday Benefits ensures uninterrupted operations, as explained in the Workday Benefits course in Hyderabad.

Individual rates are another crucial component.

Specific Workday plans require rates to be maintained externally through systems like Workday Benefits integration, which enables employees to view directly their contributions made towards Workday Benefits.

Supervising Employer Contributions in Workday Benefits

Employer contributions are the heart of Workday Benefits.

When an employer pledges to contribute $200 toward one or more Workday Benefits plans, Workday Benefits automatically updates payroll calculations accordingly and allows for automatic deductions as part of its services.

The Workday Benefits course in Hyderabad explains how automatic deductions and earnings allocations are managed when employees enrol in plans.

When dealing with other payroll systems, such as ADP and Workday Benefits, you can also perform these tasks seamlessly without any issues or glitches.

Enhancing Payroll Integration with Workday Benefits

Workday Benefits can play a vital role in payroll integration.

From setting earnings and deductions to tax management and payment processing, each stage forms part of an uninterrupted payroll system.

So, let’s first understand what payroll earnings distribution entails.

Organisations can streamline benefit allocation and ensure accurate payments using Workday Benefits, knowledge reinforced by the Workday Benefits course in Hyderabad.

When certain benefits are not available, pre-set configurations can be applied as adjustments to compensate for any coverage shortfalls.

Quick Perk Code Use with Workday Benefits

Workday Benefits assigns value codes systematically to facilitate unhindered management.

Payroll providers, such as ADP, issue these codes that authorise Workday Benefits’ system for processing benefits accurately and promptly.

The Workday Benefits course in Hyderabad explains how to configure the system by inputting worker data according to occupation or personal information.

By verifying payroll groups against configurations, errors can be reduced and the optimal operation of the system ensured.

Compensation Planning and Tax Rules in Workday Benefits

The first step towards being accommodating is understanding how Workday Benefits are taxed.

Benefits may fall under either pre-tax or post-tax categories, depending on the company’s policy.

Submitting taxes using the appropriate classification will help avoid discrepancies that might otherwise arise during payroll management.

Seamless integration of Workday into compensation plans is essential and thoroughly addressed in the Workday Benefits course in Hyderabad.

Depending on how the benefits don’t align with existing compensation structures, specific adjustments may need to be made to prevent misconfigurations and miscalculations.

Fixing Payroll Errors with Workday Benefits

Workday Benefits configuration errors can lead to payroll operation problems that negatively impact payroll operations.

Examining profit plans and integration settings early will help identify issues as soon as they arise.

Misconfigurations of benefits often lead to inequities in employees’ salaries, resulting in an irregular distribution of benefits.

Conducting periodic check-ups will ensure the proper functioning of Workday Benefits, as emphasised in the Workday Benefits course in Hyderabad.

When problems arise, reviewing configurations and consulting with the payroll teams can help quickly identify and correct errors and discrepancies.

Upgrading Employee Benefits via Workday

Workday Benefits provides businesses with an efficient means to offer flexible alternatives in dynamic scenarios for employees, including group coverage for any existing group benefit plans, ensuring fair and systematic employee selection.

Additionally, payroll administration becomes systematic over time.

By utilising Workday Benefits, companies enhance payroll operations and employee satisfaction through transparent deductions and earnings allocation, as outlined in the Workday Benefits course in Hyderabad.

Vishwak

I write because the fight to learn is just as crucial as the knowledge acquired; every click, every mistake, every little success.