Hyderabad’s #1 Choice for Workday Training in Hyderabad {2025}

Workday Adaptive Planning Course in Hyderabad

Topic Overview

Workday Adaptive Planning

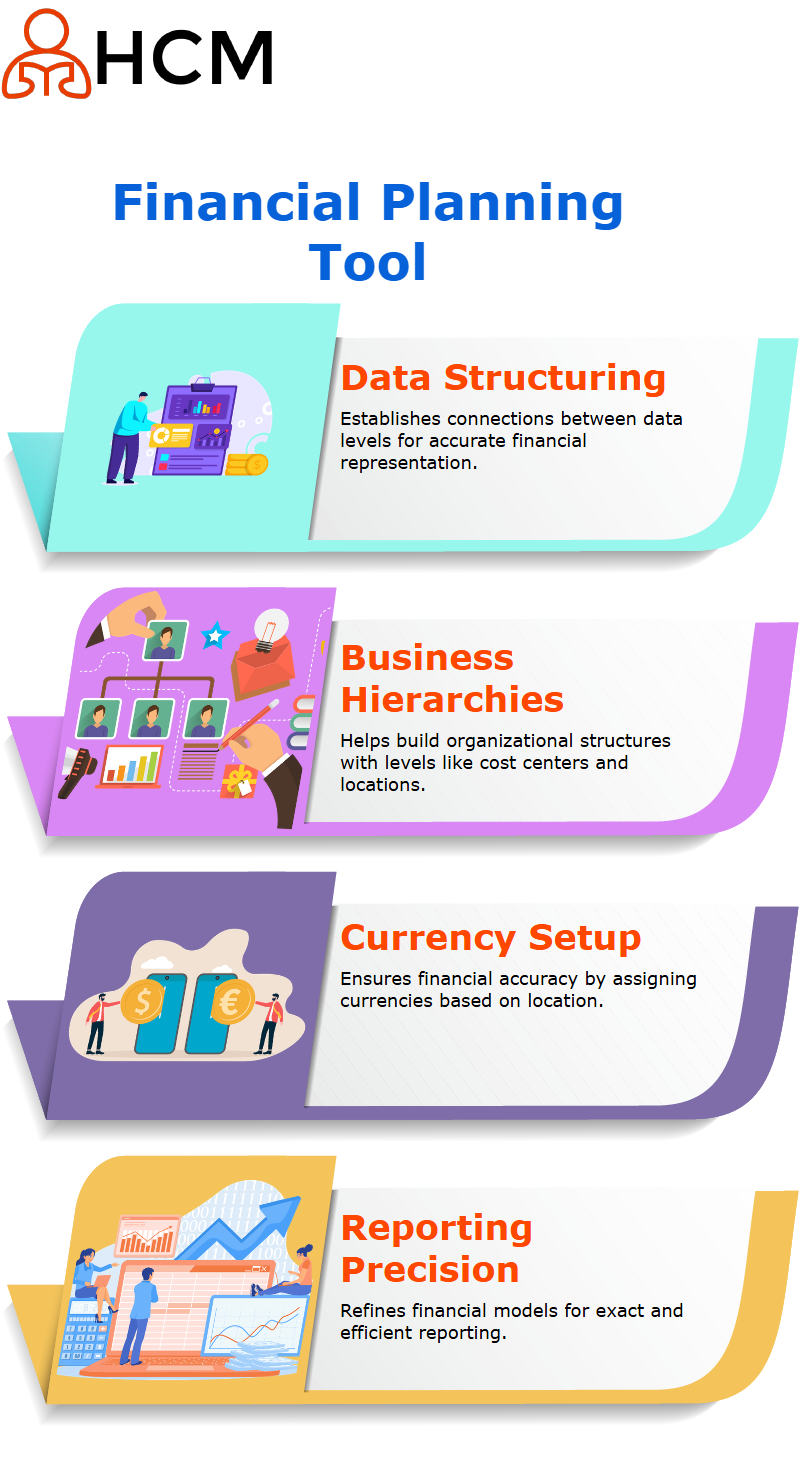

Workday Adaptive Planning is a tool that we can deploy to oversee the financial data in a more powerful and fast way.

This incredible tool has the key quality of the capability of establishing one-to-one bonds between the data levels and the elements.

This kind of structuring is thoroughly explained in the Workday Adaptive Planning Course in Hyderabad.

Construction Reports in Workday Adaptive Planning

Workday Adaptive Planning is an indispensable tool in establishing financial and operational models in a highly systematic manner.

During our most recent session, we did an in-depth investigate of their elementary components, and we observed how they form business hierarchies.

Workday Adaptive Planning is the first zero in on of the planning system with the elements such as levels, currency, versions, and qualities being the construction impediments to the model at different skulls giving the same data.

These are the elements that display the structure of the planning model and guarantee a spot-on representation of the data.

These components really polish financial models and extra lead to a more exact reporting process.

Workday Adaptive Planning consists of levels that are used to represent the organizational hierarchy, they are the dwelling barriers.

These levels can be profiting centres, cost centres, and location-based structures.

A case in point is the setup of a demo company with several regional layers.

Our task consisted of making a hierarchy that is the base for a company which has a four-countries division, several cities and several stores.

By employing Workday Adaptive Planning, we created the traffic of the link to each corresponding level and accordingly the financial status dynamically and then from level to level, we quickly moved through the structure.

To master such detailed structuring, the Workday Adaptive Planning Course in Hyderabad offers hands-on exercises and deep insights.

Currency Setup & Accuracy in Workday Adaptive Planning

The currency setup in Workday Adaptive Planning is a must-have in the case of companies with earth wide operations.

Each level is allocated a currency that is in line with its location which already confirms truthfulness when calculating financial data.

At the firm level, we are still taking advantage of the same currency for reporting.

We have examined the currency setup in Workday Adaptive Planning, sanctioning for the establishment of both convention and standard currencies.

This permits for flexibility in terms of business operations, thus facilitating uniformity, yet also the local financial conditions can be met.

The Workday Adaptive Planning Course in Hyderabad provides detailed lessons on setting up currencies accurately.

Workday Adaptive Planning Versioning and Flexibility

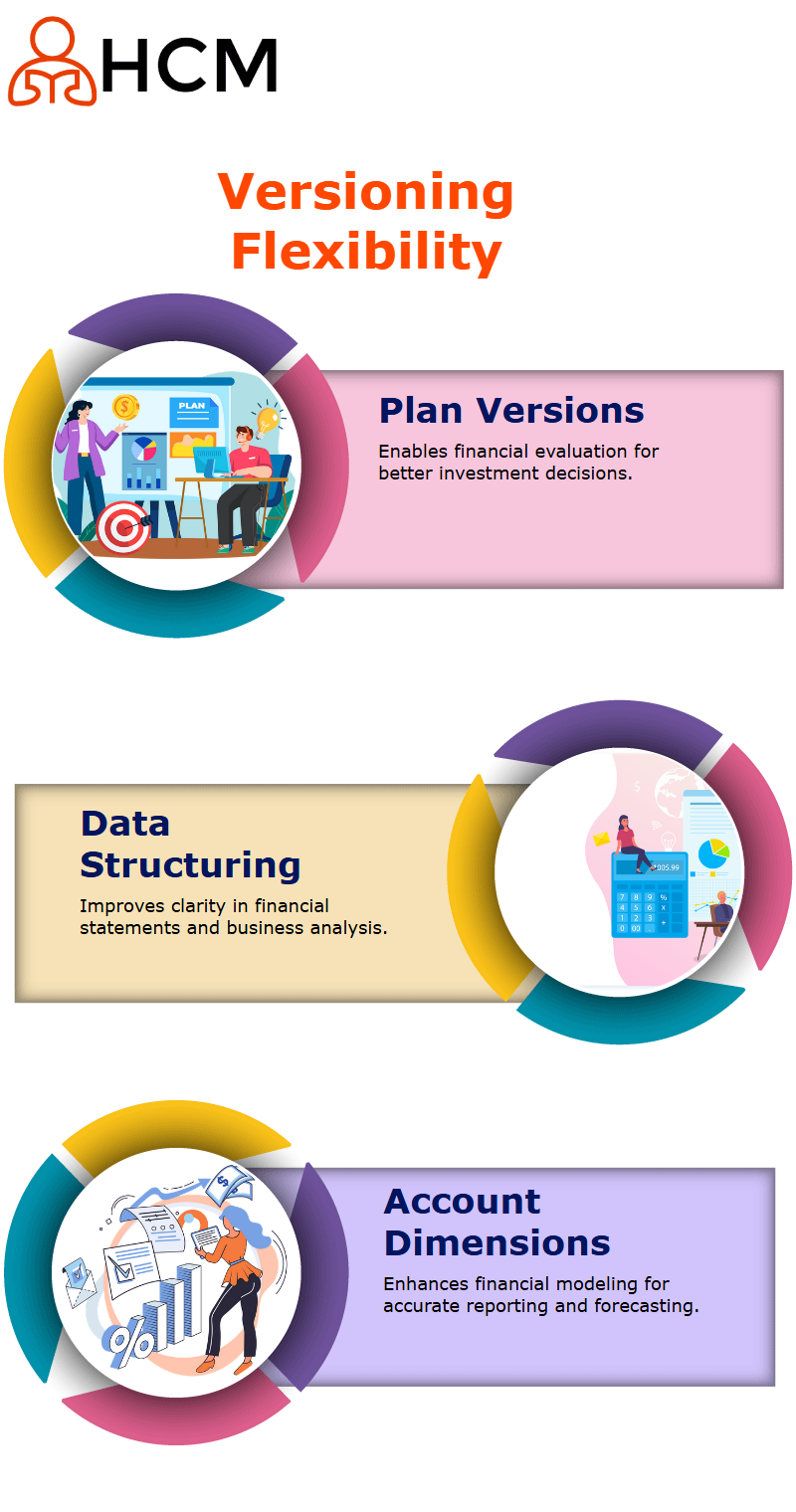

In Workday Adaptive Planning, the models of financial conditions, for demonstration, the actuals, and the foretelling, are called versions.

By creating separate plan versions, the companies can definitely evaluate the money movement and make the right investment choices.

The participants learned and tried the process of making plan versions in Workday Adaptive Planning through an illustration.

The correct interpretation in selecting the right financial context and categorizing them as versions is the plain substructure to a correct estimation and analysis.

Workday Adaptive Planning is used by companies to set level characteristics that will strengthen the clarity of financial statement data.

Blueprints like these not only make data easy to understand but also grant the user to make a business decision informed by their financial position in a certain market.

To elaborate, taking advantage of Workday Adaptive Planning, we have engineered details e.g. geographical regions that divided data into small bipolar pieces and allowed one business to evaluate its financial performance in different zones, and still, the flexibility was there in data report structures.

Another prototype of Workday Adaptive Planning talent is how it can connect to the account dimensions flawlessly.

The account dimensions are a very minute picture of financial data and therefore they help the analytical tools inside the podium to be more capable.

Through the definition of account dimensions in Workday Adaptive Planning, corporations are able to upgrade their financial models and directly incorporate the reporting parameters in the process.

The latter strategy guarantees that the delivered pleased vestiges standardized across multiple variables.

For a full grasp of versioning and flexibility, the Workday Adaptive Planning Course in Hyderabad provides practical examples and exercises.

Real World Application Workday Adaptive Planning

Financial business intelligence software like Workday Adaptive Planning, organizations are now augmented positioned to take on kinetic shifts in financial models quickly and easily.

Organizations sympathy how to set up the components competently, that guarantee they are appropriately and skilfully developing the strategy.

The main practical implementation concentrate of our course was how to administer plans and adjust in Workday Adaptive Planning.

Besides attaining familiar with the software, mainly through repeat, the participants got the right answers on this subject through the practical exercises.

The implementation of models in Workday Adaptive Planning software is rather an advantage than just a possibility.

With levels, currencies, and characteristics, the organizations can progress extended into the field of financial analysis.

By protecting these values, the company can easily make opinions on the financial planning and reporting.

Workday Adaptive Planning is still the tool that could help organizations to perform financial tasks quicker and in an elevated way.

The businesses’ awareness of the software resources is the only help for attaining more and competent execution of the tool.

Our demonstration dug into how the software Workday Adaptive Planning has a positive influence on the divisions of presaging, budgeting, and financial structuring.

Clarity these devices with real-life contingencies will definitely help people have a augmented perception of it.

We can also reflect on the things learned from Workday Adaptive Planning through the practical exercises which revolve around financial model structuring.

This, coupled with practical exercises, is not only good for us but also solidifies our product knowledge!

Attending a Workday Adaptive Planning Course in Hyderabad enhances understanding through such practical exposure.

Managing Levels in Workday Adaptive Planning

Throughout the Workday Adaptive Planning, levels are implemented to show different parts of the hierarchy of an organization in a financial model.

The labels of these levels can be decorated with properties like continents for fidelity in reporting and analysis.

A deep dive into managing levels is part of the curriculum in the Workday Adaptive Planning Course in Hyderabad.

Accounts in Workday Adaptive Planning

In the Workday Adaptive Planning system, the accounts do not really describe the financial data but they are there to provide the user with a means of keeping the financial data.

The accounts work as a repository of all those facts and figures that would be useful for the coherence of the budgets and the truthfulness of the predictions.

The concept can be explained as an Be outstanding sheet that a person can fill out manually or use formulas to calculate the data.

In Workday Adaptive Planning a variety of items like asset, expense or business metric are linked with the accounts.

The comprehension of the account structure is the basis for premises a true financial model.

Those looking for in-depth knowledge often join the Workday Adaptive Planning Course in Hyderabad to master these account structures.

Workday Adaptive Planning General Ledger Accounts

Workday Adaptive Planning has set general ledger accounts that are not erasable.

These accounts cover required finance parts such as assets, the money owed to the bank, and the costs.

Leaving users the possibility to modify different identifiers or insert new accounts in their place proves to be very beneficial when it comes to the functioning of the Workday Adaptive Planning ledger through the use of the updated version of the online collaboration.

The creation of an organized ledger in Workday Adaptive Planning through the utilization of optimized financial processes gears up the company in terms of finances.

Participants in the Workday Adaptive Planning Course in Hyderabad are taught how to optimize ledger accounts effectively.

Ceremony Accounts and Their Role in Workday Adaptive Planning

Workday Adaptive Planning ceremony accounts show flexibility component.

Whenever standard general ledger accounts are unable to submit the characteristics, users are examining for, they are given the free selection to devise accounts that can meet the purpose.

Thus, product revenue that may not fit into the regular categories can be given as a prototype of the problem in this situation, tradition accounts will equip the users to modify the financial models to suit the exact business stipulations.

Understanding these concepts is a key part of the Workday Adaptive Planning Course in Hyderabad curriculum.

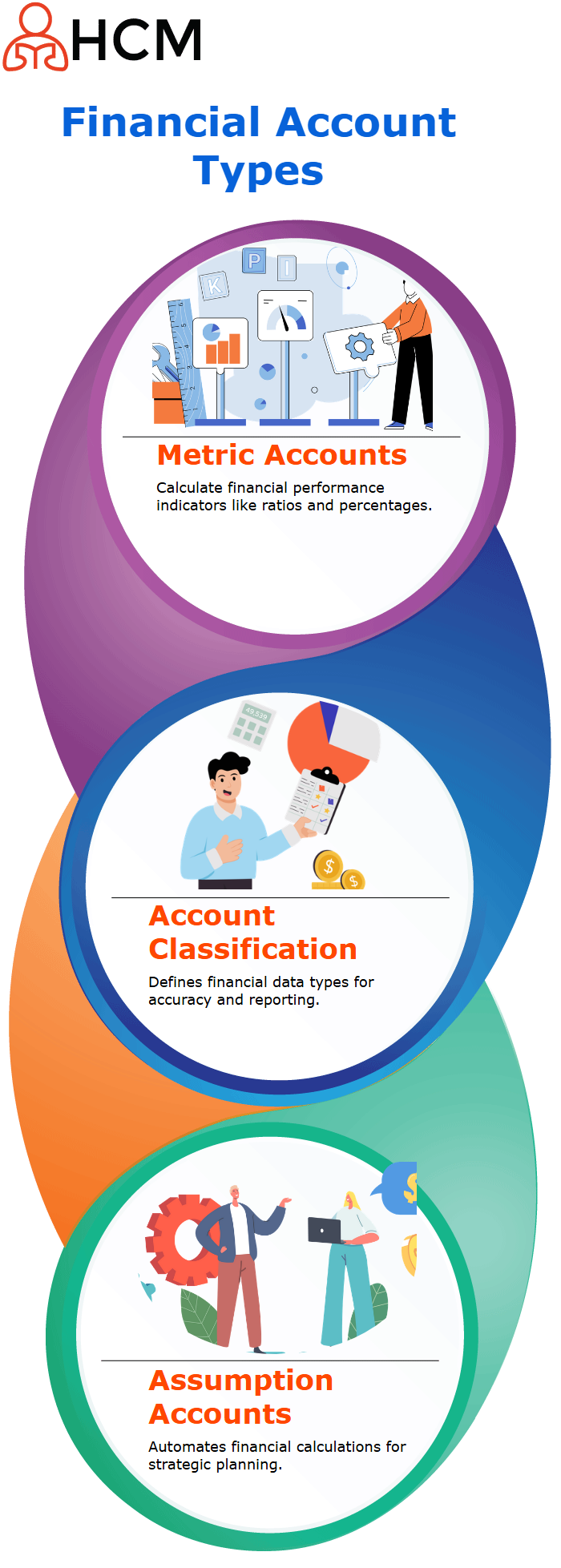

Metric Accounts in Workday Adaptive Planning

Metric accounts in Workday Adaptive Planning are the means to calculate, guardian, and inspect percentages, ratios, and financial performance indicators as an example, the data such as gross margin percentage, net income percentage, and likewise metrics.

Those accounts perform a key position in protecting the strategic plan for the financial stability and profitability of businesses.

Awareness Workday Adaptive Planning Accounts

It appears that percentage-based accounts are more suitable as metric accounts of the same input than as, for representation, general ledger (GL) or customer accounts.

Workday Adaptive Planning automates the process of organizing financial data and knowledge of the account type is principal for managing financial data veracity.

Metric accounts are used to calculate financial ratios and customer accounts can be defined and shaped to the conditions of the company while GL accounts are types of the balance sheet.

With Workday Adaptive Planning, it is not only less time-consuming but easier too to make the accounts properly disseminated and directed so you can know where different accounts are standing in a very short spread of time.

In Workday Adaptive Planning, dealing with financial data, it is mandatory to be able to understand, which are used to calculate the percentages, and that can be specially drafted for numerous tasks.

This separation of the two accounts is indispensable to the financial report being error-free this distinction cannot be overemphasized.

Those wanting a deeper understanding often join the Workday Adaptive Planning Course in Hyderabad to master account classifications and accuracy.

Construction Accounts in Workday Adaptive Planning

We are through with the elementary accounts, let’s go to the assumption accounts in Workday Adaptive Planning for the next step Imagine a company with a headcount of 1,000 employees who wants to give all staff a 10% salary raise.

In Workday Adaptive Planning, this assumption can be treated as a driver such that the increase will be done on an automatic basis to all employees.

In the incident of a raise in individual salary, the process should be conducted in a different way, quite often in the constraint of customer accounts, and not assumptions.

With Workforce Adaptive Planning, businesses are able to productively supervise such differences.

Moreover, Workday Adaptive Planning presents three types of sheets standard sheets, cube sheets, and model sheets.

A standard sheet is similar to an Exceed file that embraces accounts, time, levels, and versions.

A cube sheet is created with dimensions, and a model sheet is generated when the rows and columns are being increased.

Mastering the use of these sheets is thoroughly covered in the Workday Adaptive Planning Course in Hyderabad.

Generating Your Own Accounts in Workday Adaptive Planning

Next up, release’s go forward and construct another account in Workday Adaptive Planning. Assume we are in need to lane both the expenses on salaries and the expenses on tending costs.

We need to give the account a name and code of it, Workday Adaptive Planning needs codes to be in conformance with a set of certain rules spaces should not be included, but underscores are still acceptable.

If the account is successfully created, Workday Adaptive Planning gives users the ability to do such actions as assigning duties, providing a description, and making it a periodic or a cumulative account.

These alternatives are decisive in the establishment of the financial data flow Periodic accounts are for adding up of the given period figures, while cumulative accounts contain values that are historical.

The decision of the type of selecting will be based on the Workday Adaptive Planning financial reporting needs.

For professionals aiming to excel, the Workday Adaptive Planning Course in Hyderabad guides on creating and managing accounts effectively.

Vishwak

I write because the fight to learn is just as crucial as the knowledge acquired; every click, every mistake, every little success.