Hyderabad’s #1 Choice for Workday Training in Hyderabad {2025}

Workday Finance Course in Hyderabad

Topic Overview

Creating Custom Reports in Workday Finance

Here’s where the real action begins: Imagine having complete control of your data while designing reports tailored to your needs based on their output.

It’s fascinating, right?

To get things underway in Workday Finance, type “create custom report”.

This task opens many opportunities, and the beauty of it all is that you can choose among various report types like advanced, matrix or composite reports to meet any implementation need.

These three hold immense value, so we must prioritise advanced reports.

So, let’s spend some time on that front right now.

Exploring Advanced Reports in Workday Finance

Workday Finance’s advanced reports can be an attractive feature.

They allow you to seamlessly leverage web services and import report data, providing the perfect option when designing layouts in Studio tools or similar programs.

At the core of every report lies its data source. Think of it as your report’s foundation.

For example, creating customer invoice reports might involve selecting ‘customer invoice document” as a data source and adding necessary columns.

Setting Up Columns in Workday Finance Reports

Columns form the cornerstone of any report in Workday Finance.

Our columns reflect your desired headings and values. For instance, for a customer invoice report, we might include the customer’s company name, invoice date, amount due, payment status, etc.

Keeping all the essential details together ensures they can easily be captured, for instance, when invoice amounts include options like net amount, total with and without tax and signed amounts.

Workday Finance’s ability to customise these parameters makes the platform unique among financial services tools.

Managing Security and Sharing in Workday Finance Reports

Maintaining data security when working with Workday Finance requires carefully managing report access.

Only authorised users should share report definitions to protect sensitive information.

Workday Finance course in Hyderabad controls who can access each data source, giving you full command over reports.

Maintaining strict access protocols ensures that only authorised individuals can view or interact with custom reports created with Workday Finance.

Getting Started with Workday Finance

Even if your team consists of 25 individuals, the Workday Finance course in Hyderabad makes accessing sensitive data easy with its selective sharing feature, while providing greater privacy protections over sensitive material.

Workday Finance makes sharing reports a straightforward experience by first configuring and activating settings.

Once complete, multiple values and parameters can be saved as saved parameters to run reports without reconfiguring each time around.

Saving both effort and time while upholding accuracy in financial operations.

Freezing Columns in Workday Finance Reports

Workday Finance reports provide an effective feature for freezing columns.

Let’s say your report contains essential columns such as the invoice number.

Freezing the first one ensures it stays fixed while strolling through large data sets.

Additional ones can be added without interrupting its function, thus streamlining the data review process.

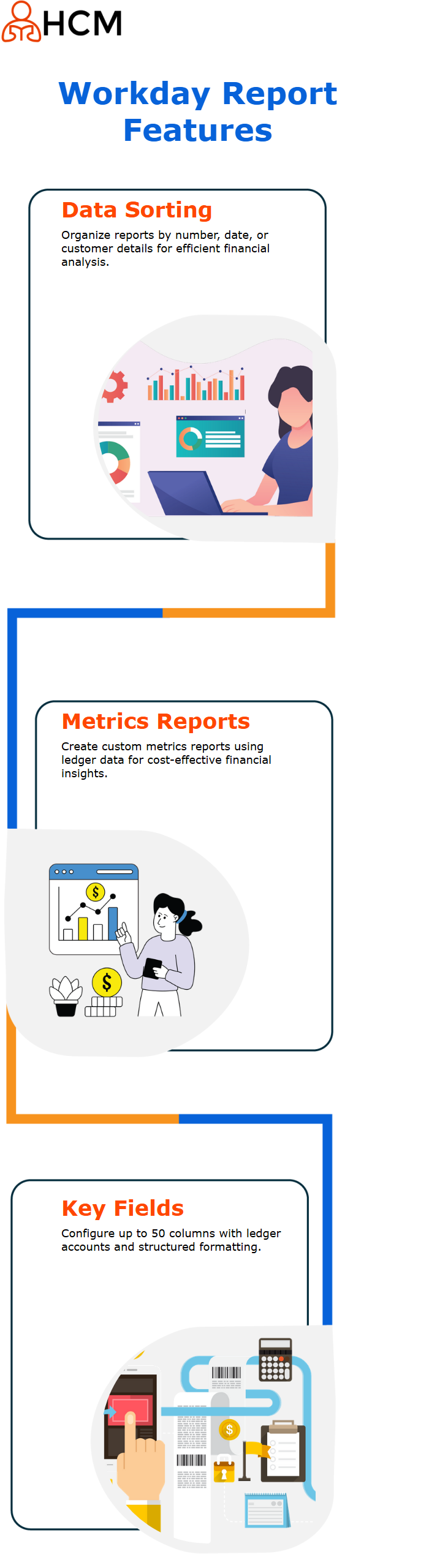

Sorting and Organising with Workday Finance

Workday Finance course in Hyderabad makes sorting data an effortless task, whether that means by number, date, customer alphabetically, etc.

Simply one click away will help you quickly access and organise what matters.

Exploring Metrics Reports in Workday Finance

Workday Finance’s custom metrics reports can provide another powerful feature for financial analysis.

With general ledger data as your starting point, creating custom metrics reports covers most reporting needs efficiently and cost-effectively.

Workday Finance’s metrics reports offer slightly different features from its advanced reports, with options like column grouping and summarisation fields to add depth and functionality to your financial reporting process, guaranteeing comprehensive insights for you as a user.

Exploring Workday Finance: Setting Up Key Fields

Let’s dive right in and configure key fields of a report.

We limit ourselves to eight columns, but it could easily accommodate 50.

Why so few? Because simplicity is at the forefront of the Workday Finance course in Hyderabad.

Begin by setting up fields. Add ledger accounts and go deeper with details such as company and cost centre information.

Everything should remain uniform, with an ascending or descending format applied consistently across fields. Workday Finance emphasises seamless structure.

Workday Finance makes this task straightforward by offering various summation types, including count, calculation, percentile and sum, which enable us to view both beginning, debit/credit activity, and ending balances.

When using “sum”, we can see the exact total of each field and thus see its balance beginning, debit-credit activity, or ending.

Balancing and Formatting in Workday Finance Reports

Workday Finance’s formatting features work wonders. To calculate the beginning balance, we consider debit minus credit activity from ledger debit accounts and assign this sum a label: beginning balance, using the universal format.

Workday Finance enforces consistent formats that include debit amount, credit amount and balanced results.

Add precision by opting for a per cent column or an overall total for greater accuracy, or display your currency symbol for better visualisation.

The Power of Composite Reports in Workday Finance

Workday Finance’s composite reports are one of its hallmark features, collating information from metrics reports without drawing data from external sources to create centralised and organised datasets.

Workday Finance Course in Hyderabad gives users access to hidden fields by setting prompt defaults.

We can see over 20 values here that unlock deeper insight.

Don’t feel limited. Workday Finance provides access and refines details as necessary.

Exploring Workday Finance

Workday Finance can be an easy and intuitive tool, yet there can be subtleties you don’t realise are present.

For instance, specific updates are marked mandatory and cannot be unchecked without running into errors.

Any attempt at doing so results in an error message and, consequently, can seem restrictive; that is just how Workday Finance operates.

Let’s now address balancing work types. Many are redundant in the second column.

You could unclick ‘Do Not Prompt at Runtime’ for unnecessary values like work tags or port effective dates that used to appear in reports.

That way, your reports become much cleaner, saving us from dealing with too much unnecessary data within Workday Finance.

Running reports in the Workday Finance course in Hyderabad is fascinating.

Once you input values like BGC amount types, activities will appear calculated as debit-minus-credit activities for ease of viewing beginning or ending balances within their interfaces.

It feels completely seamless when moving around Workday Finance.

Need to look back over specific periods in Workday Finance?

That is no problem. Its flexible features allow for the stunning customisation of periods you wish to analyse.

Set the current period from January to December for any given financial year, or go further back than 12 or 36 months to do that.

Its flexibility provides invaluable benefits in managing financial transitions through Workday Finance.

Workday Finance makes composite reports very intuitive to create, and you connect business objects to specific ledger accounts for more profound insight. Workday makes this operation effortless.

Customising Reports in Workday Finance

Workday Finance makes creating custom reports simple.

All it requires is selecting composite data sources and loading any desired reports.

This way, the Workday Finance course in Hyderabad focuses your attention on business objects with specific values like ledger accounts.

At Workday Finance, our accounts enable us to easily view specific account balance transitions, like debit or credit balance changes and produce actionable summaries that align perfectly.

Workday Finance ensures everything aligns perfectly for seamless processes by saving time and easing complex processes.

Workday Finance Columns and Rows Explained

Workday Finance makes understanding columns and rows essential for practical use, much like Excel sheets.

There are rows with columns similar to what would appear in any typical spreadsheet application.

Data entering these columns becomes exciting as soon as it starts entering them.

For instance, by clicking on one column and then drilling down, you may see options to customise the type and structure of how financial data is organised.

This feature offers both flexibility and structure when organising financial information.

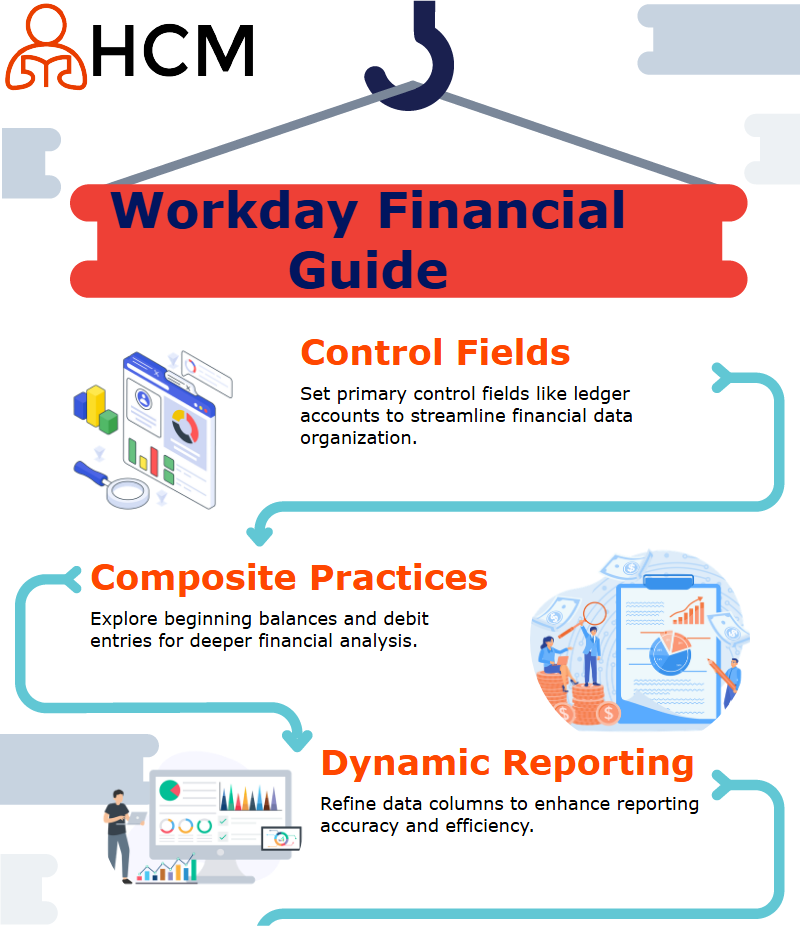

Workday Finance Setting Up Your Control Fields

Workday Finance’s control fields play a central role in organising data.

Leather accounts often act as primary control fields and serve as the cornerstone for data organisation, with additional fields like company being added easily as new layers are revealed by Workday Finance, making reporting efficient and seamless.

Workday Finance Exploring Data with Composite Practices

Beginners to the Workday Finance course in Hyderabad may initially find the learning process daunting.

Exploring its various practices, beginning balances, debit balances or any company-specific details, requires diving deep.

Proactive users find that consistent practice leads to faster mastery, so take your time exploring its features until soon enough you are easily manoeuvring Workday Finance.

Workday Finance Using Data Columns for Dynamic Reporting

Dynamic reporting in the Workday Finance course in Hyderabad begins by understanding data columns.

For instance, setting the beginning balance or debit amounts can unlock many insights.

Once this foundation has been laid down, refinement of your columns (either via manual adjustments or duplicating existing setups to save time) can significantly boost reporting efficiency and ease.

Workday Finance Leveraging Matrix Reports

Matrix reports are an incredible feature within Workday Finance that aggregate data beautifully, providing a thorough view at a glance.

By including key fields like beginning balance, credit amount, and debit amount, you can tailor these reports specifically to meet your needs.

Their duplicating feature even allows quick adjustments without starting from scratch.

Workday Finance Unveiling the Power of Settings

Deep dive into the Workday Finance course in Hyderabad and uncover some exciting features that make the workflow seamless.

Issues will always arise, but here’s the trick–magic is in the settings.

Have you seen that gear-like icon?

Workday Finance’s settings enable you to define products and set default values; only six are available to get you started.

Assuming you wish to support or play around with it further, you could label items such as GMS USA while setting its period.

The Workday Finance course in Hyderabad can assist by aligning everything perfectly for you.

Workday Finance Reports and Custom Styles

Report customisation can be great fun. Say you find an incomplete report but are missing its total column.

Furthermore, styles like bold text, double underlining or border layers allow for personalised reports with professional appeal–just like Excel but on steroids.

Workday Finance makes customisation even simpler by offering flags as indicators.

Set an alert whenever your balance falls below $25,000 using Workday Finance.

Create any combination of blue, green or purple flags, engaging visualisation.

Plus, learn how dynamic reports become with the Workday Finance course in Hyderabad.

Learn how to combine Data for Dynamic Insights in workday finance

Workday Finance excels at dynamic data combination. By seamlessly merging different accounts’ data to produce comprehensive insights effortlessly.

This powerful application gives users access to powerful yet creative ways of manipulating the numbers, resulting in a more profound understanding.

Imagine dynamically loading rows that update as parameters change or seeing total balances evolve as parameters shift.

You could never get this sort of control before with traditional spreadsheet software.

Workday Finance course in Hyderabad allows users to use data creatively while uncovering more profound truths.

Star-rating feature gives those with an affinity for data the tools to assess trends visually.

From rating accounts or totalling totals, Workday Finance gives data enthusiasts everything they need to explore, transform and turn data into actionable strategies.

It is truly an endless playground.

Exploring Workday Finance Streamlining Your Workflows

Workday Finance makes life simpler by helping us simplify daily tasks.

Have you noticed the extra time saved when everything is organised properly?

Workday Finance simplifies things such as managing values, organising subgroups and more for maximum efficiency and time savings.

Practical Tips in Workday Finance

One significant aspect of Workday Finance is working with value thresholds.

For instance, setting limits below $25,000 in various categories is simple with Workday Finance: adjust its settings, and it takes care of everything within one place.

Workday Finance course in Hyderabad makes correcting issues immediately easy, intuitively so, so as not to waste your precious time.

If red or grey flags arise in Workday Finance, don’t fret, use its functionality immediately, and you will stay on top of things without losing precious minutes.

Getting Creative with Workday Finance Reports

Workday Finance makes report creation an efficient experience, offering customisable headers and footers with specific instructions, such as warnings about making changes to a report without permission, or inputting contact numbers should any mismatch arise between numbers on reports and those listed by them.

Launch your report, and your custom text appears.

These small details make the Workday Finance course in Hyderabad such an indispensable resource.

Experimenting with Workday Finance Functionalities

As you explore Workday Finance more thoroughly, its many features become clear.

Experiment with document templates, customise data presentations and develop efficient workflows.

With practice comes mastery: the more often you use the Workday Finance course in Hyderabad, the quicker its features become second nature.

Be sure to explore and experiment.

Workday Finance was built for ease of use, but it requires time spent learning its full capabilities for maximum impact.

Vishwak

I write because the fight to learn is just as crucial as the knowledge acquired; every click, every mistake, every little success.